What is the function of the Assessor?

The Assessor and his/her deputies are directed by West Virginia Constitution, Article X, Section I, to determine the value of all real and personal property at fair market value for each tax year. The specific duties of the Assessor are to discover, list and value all Real and Personal property located within the boundaries of the county on an annual basis. All valuations must occur on a fiscal year basis commencing on the first day of July.

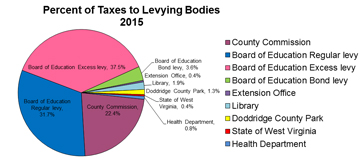

The Assessor does not set your property tax. Your tax bill is determined by multiplying a tax rate (levy rate) by your assessed value (60% of market value). The assessor determines your assessed value. The legislature, board of education, the county commission, and the municipalities determine the levy rates. Levy rate information may be obtained in the Assessor's office.

The Assessor's office provides certified values to each levying body. Once this is completed, the levying bodies (county school board, county commission, etc.) approve their levy rates. Levy rates may rise or fall depending on the amount of funding that each levying body requires.

The Doddridge County Assessor’s Office locates, lists and appraises the value of over 23,000 real property parcels, 4,000 mineral parcels and 15,000 personal property accounts, as well as collects county dog taxes. The office also maintains tax maps and property records cards, making them available for public use.

What is Fair Market Value?

Fair Market Value" is the price of property that would be agreed upon between a willing and informed buyer and informed seller under usual and ordinary circumstances. It is the highest price a property would bring if it were exposed for sale on the open market for a reasonable period of time.

When is property Assessed?

All properties are assessed as of July 1st each year.

How are the taxes determined?

Market Value X 60% (.60) = Assessed Value

Assessed Value X Levy Rate = Taxes

What is Real Property and how is it assessed?

Real Property is land and structures affixed to the land. Real property is assessed annually at 60% of its market value as determined by WV State Code.

What is Personal Property and how is it assessed?

Personal Property is all property that is not considered real property. It is moveable. Examples of personal property are: vehicles, boats, campers, motorcycles, ATVs, Chattel real(leases), buildings and mobile homes on someone else's land, machinery & equipment, inventory, computers, furniture & fixtures, etc. Personal property is assessed annually at 60% of its market value as determined by WV State Code.

What are the different tax classes?

Class II - All property owned, used and occupied by the owner exclusively for residential purposes; All farms, including land used for horticulture and grazing, occupied and cultivated by their owners or bona fide tenants

Class III - All real and personal property situated outside of municipalities, exclusive of Class II

Class IV - All real and personal property situated inside of municipalities, exclusive of Class II

Where and how do I pay my taxes?

The Doddridge County Sheriff's Office-Tax Department is located at 118 E Court St Rm 103 in West Union, WV. They are open Monday - Friday 8:30am-4:00. Please direct all phone inquiries to 304-873-1000.

Property taxes are issued once a year on July 15th. Current year taxes cannot be paid prior to July 15th. Taxes may be paid for the full year or in halves. If the full year or first half is paid on or before Sept. 1, a 2 ½ % discount is given. If the 2nd half is paid on or before Mar.1, a 2 ½ % discount is given. First half taxes begin accruing interest at the rate of 9% per annum if not paid on or before Oct. 1. The second half taxes begin accruing interest at the rate of 9% per annum if not paid on or before April 1.

Payments may be received in the forms of cash, check, cashier's check or money order. Debit/Credit cards are not accepted at this time.

What is Homestead/ Disability exemption?

§11-6B-3. An exemption from ad valorem property taxes shall be allowed for the first twenty thousand dollars of assessed value of a homestead that is used and occupied by the owner thereof exclusively for residential purposes, when such owner is sixty-five years of age or older or is certified as being permanently and totally disabled provided the owner has been or will be a resident of the state of West Virginia for the two consecutive calendar years preceding the tax year to which the homestead exemption relates: Provided, That an owner who receives a similar exemption for a homestead in another state is ineligible for the exemption provided by this section. The owner's application for exemption shall be accompanied by a sworn affidavit stating that such owner is not receiving a similar exemption in another state: Provided, however, That when a resident of West Virginia establishes residency in another state or country and subsequently returns and reestablishes residency in West Virginia within a period of five years, such resident may be allowed a homestead exemption without satisfying the requirement of two years consecutive residency if such person was a resident of this state for two calendar years out of the ten calendar years immediately preceding the tax year for which the homestead exemption is sought. Proof of residency includes, but is not limited to, the owner's voter's registration card issued in this state or a motor vehicle registration card issued in this state. Additionally, when a person is a resident of this state at the time such person enters upon active duty in the military service of this country and throughout such service maintains this state as his or her state of residence, and upon retirement from the military service, or earlier separation due to a permanent and total physical or mental disability, such person returns to this state and purchases a homestead, such person is deemed to satisfy the residency test required by this section and shall be allowed a homestead exemption under this section if such person is otherwise eligible for a homestead exemption under this article; and the tax commissioner may specify, by regulation promulgated under chapter twenty-nine-a of this code, what constitutes acceptable proof of these facts. Only one exemption shall be allowed for each homestead used and occupied exclusively for residential purposes by the owner thereof, regardless of the number of qualified owners residing therein.

What is Managed Timberland Tax Incentive Program and how do I apply?

Managed Timberland is a tax incentive program. The State of West Virginia recognizes the value of managing this resource. This tax incentive approach was enacted to encourage landowners to actively manage their forest land thereby increasing the amount and quality of the resource. The appraised value of Class II, III, and/or IV forested property is reduced under Managed Timberland. It is based on the ability of the land to produce future income according to its use and productive potential, market comparables and market analysis. The initial Contract is due before July 1 of any year. The annual Application for Certification as Managed Timberland must be submitted to the Division of Forestry between March 1 and September 1 of each year to remain in the program. For more info on this program call 304-558-2788 or write the WV Division of Forestry, 1900 Kanawha Blvd. East, Charleston, WV 25303-0184.

What is "farm use"?

Actively farmed tracts that produce at least $1,000 of agricultural products qualify for the farm use exemption. The property must also meet the ratio of agricultural use to other uses of the property, such as woodland. Taxpayers who have applied for the exemption in the previous year will be mailed an application on July 1. The application must be filed each year by September 1st. in the Assessor's Office. The program reduces the price per acre on land listed as farmland, such as pasture and tillable.

What is the Sheep & Goat Program?

This passed during the 2004 legislative session and it provides that assessors should collect $1.00 per head on all breeding age sheep and goats. The money is deposited into a special account designated "Integrated Predation Management Fund", which will be used solely to enter into a cooperative service agreement with the U.S. Dept. of Agriculture to expand the coyote control program. Farmers pay the $1.00 per head at the time of their assessment and, if the farmer has a sheep or goat killed by a coyote, he can contact the Dept. of Agriculture and have the coyote trapped and removed from his property.

IMPORTANT DATES

July 1 – Taxes are assessed to the owner of record based on July 1 for real and personal property.

September 1 – WV Farm Use Applications filing deadline.

September 1 – Business Personal Property Returns filing deadline.

October 1 – Personal Property Assessment Forms filing deadline.

October – Board of Assessment Appeals meets to hear valuation appeals.

December 1 – Homestead Exemption Applications filing deadline.

January – Dates are set by the Doddridge County Commission for Board of Equalization and Review hearings. If real property assessed values increased by 10% or more of the previous year, increase notices are sent.

February 1-20 – Board of Equalization and Review meets to hear appeals of value. Contact the Doddridge County Assessor's office or the Doddridge County Commission Office for dates and times of meetings.

February 20 – Last day to file protest for the Boards of Assessment Appeals to be held in October. .